Report: Payment services for SMEs – Jump-starting digital payment services

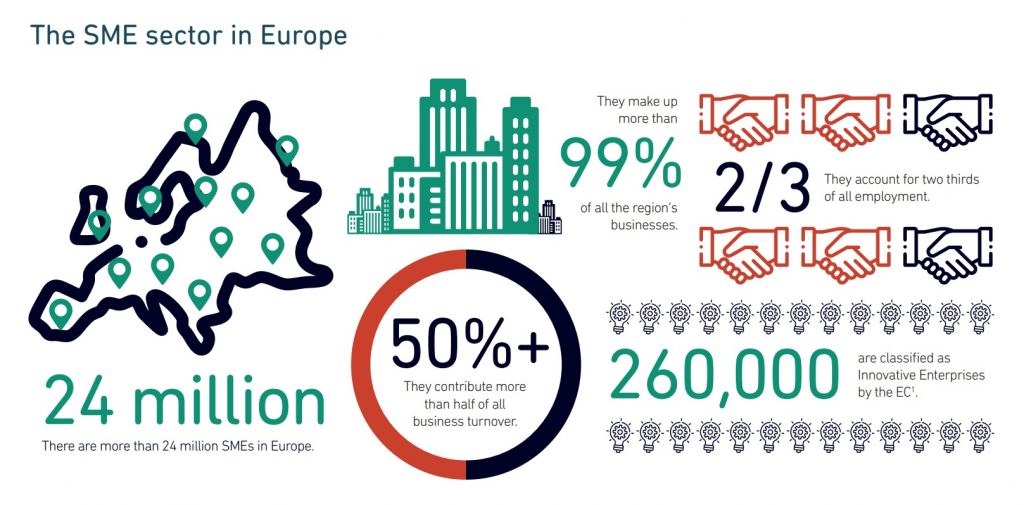

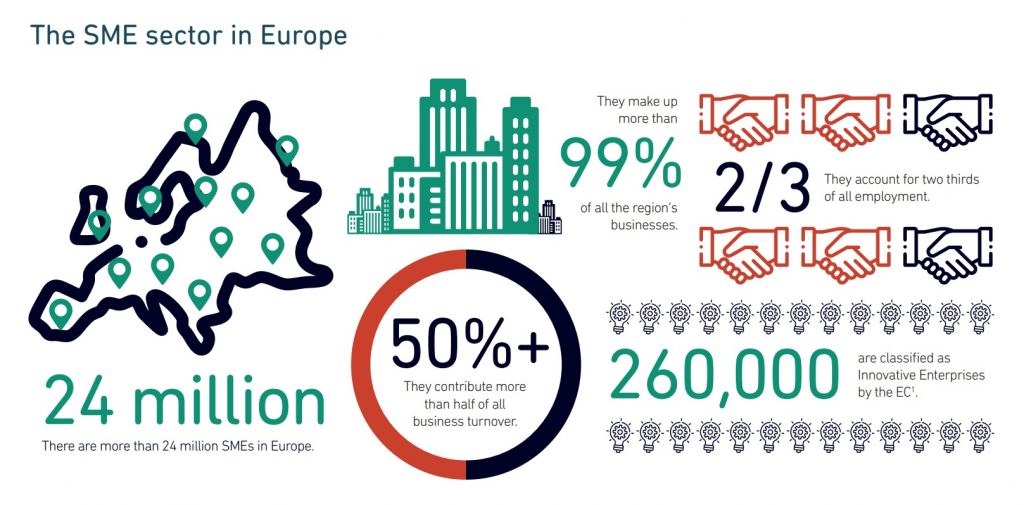

Financial inclusion for SMEs is a hot topic for European governments, financial institutions, banking representatives and small business associations. All recognise that SMEs are a significant part of the region’s economy and agree that enabling and improving access to funding is a priority.

However, conversations with SMEs and service providers make it clear that this interpretation of financial inclusion is too narrow. Access to financing and funding has certainly increased in the past few years, but this success – valuable and necessary though it is – can often disguise SMEs’ dissatisfaction with the financial services available to them.

According to a new report from Banking Circle, many are wrestling with payments solutions that do not meet their specific needs. This is unhelpful in itself. But it also sets up a negative idea that there is little to be gained by developing services specifically for SMEs.

Viewed in this way, financial inclusion among SMEs actually remains a significant problem. Even the most disruptive FinTechs and Payment Service Providers (PSPs) have focused more on larger businesses or individual consumers over SMEs.

That can and should change. Digitisation in particular holds the potential to transform payments and related services as part of a broader and far more comprehensive set of financial services for small businesses.

Much of the problem lies in the nature of Europe’s SME market itself – or more accurately, Europe’s many SME markets. Small companies dominate the business landscape, but are dispersed, diverse and highly differentiated.

“There’s no data on them and so it’s expensive to reach out to them,” says Ivo Gueorguiev, the chairman of Paynetics, an infrastructure payments provider to FinTechs and smaller players.

“There’s no data on them and so it’s expensive to reach out to them,” says Ivo Gueorguiev, the chairman of Paynetics, an infrastructure payments provider to FinTechs and smaller players.

Economies of scale have been hard to achieve, which reduces the affordability and consequent viability of SME solutions. Hence the shortage of solutions.

Kent vorland, the CEO of Smarttrade app, a platform for micro-businesses and sole traders, has seen the consequences of this in action with providers who try to attract SMEs with consumer products on the one hand or enterprise services on the other.

“[Consumer products] are not agile enough and providers have little knowledge of small businesses,” he points out. “Equally, the big boys have complicated functionalities, but nothing optimised for small merchants.”

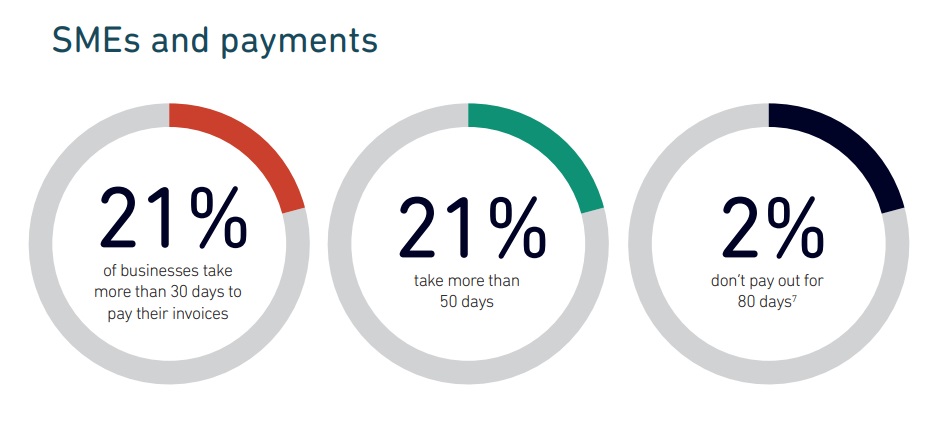

In fact, scratch the surface and tales of late payments, limited access to efficient transaction services and restricted credit lines quickly emerge. Common complaints from SME owners often concern the lack of such essentials as access to payment services or the time it takes to open a merchant account, or support for accounts payable.

David Selves, an entrepreneur and owner of the Selves Group of companies explains why this can be such a big problem: “Three to five banking days for card payments is still the norm, which causes considerable issues for many small businesses who need to restock rapidly.”

Michael Ault, the CEO of universal transaction Processing, agrees: “[SMEs] have already been through an arduous process to get a merchant services account, and then it takes days to get their funds.”

Despite SMEs exporting goods worth 12% of EU GDP in 2018, cross border payments remain a challenge, especially for online retailers. As Phil McGriskin, CEO at Vitesse, explains: “due to bank fees, the amounts actually received vary from the amount expected. When invoicing, it’s difficult to know how much you need to add for transaction fees.”

To access the full report click HERE