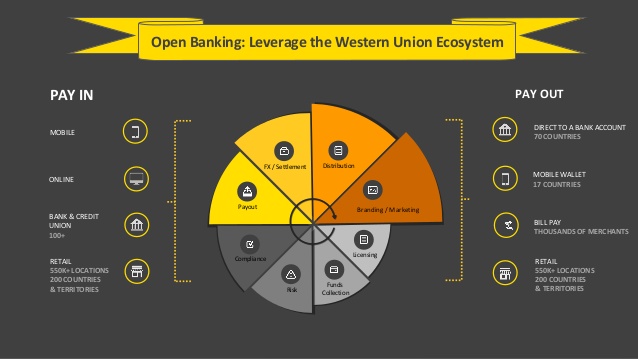

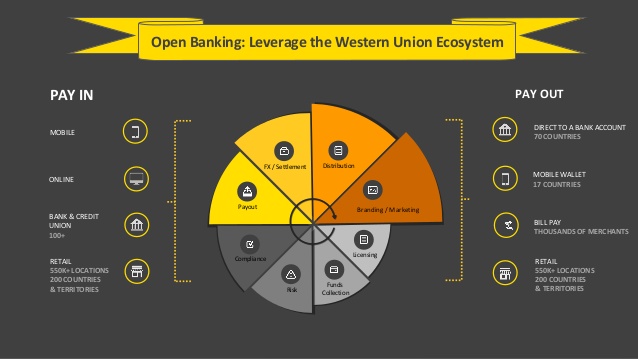

Western Union delivers Open Banking API for global payments

Western Union has deployed full Open Banking application programming interface (API) access to its supporting front-end domestic and international payment applications through its Western Union Business Solutions unit.

This new set of APIs provides approximately 37,000 business customers the opportunity to integrate their financial institutions, accounting and enterprise resource planning (ERP) systems and their account on GlobalPay.

This new set of APIs provides approximately 37,000 business customers the opportunity to integrate their financial institutions, accounting and enterprise resource planning (ERP) systems and their account on GlobalPay.

The benefits of the API integration include streamlining payments processing and providing visibility to transaction and account history. In addition, the set of APIs provides transparency to foreign exchange rates, transaction costs and applicable fees and offer the latest forms of regulated European internet security.

“Through this investment, we have enriched our API capabilities to ensure our customers receive a best in class experience when using our products and integrating their data,” says Scott Johnson, global head of product for Western Union Business Solutions.

The APIs also offer the latest level of regulated European internet security, with Johnson adding: “Our goal is to help customers integrate their data, in turn expanding their global reach and managing their international payments more efficiently, while maintaining our commitment to leading the industry in offering the highest standards of security.”

This means that Account Information Service Providers will have better consolidated account visibility and Payment Initiation Service Providers will be able to integrate with Western Union Business Solutions’ vast payment network and correspondent banks, which support domestic and cross-border payments in over 130 currencies.

The release of the suite of APIs corresponds to the European Open Banking, Payment Services Directive 2 (PSD2) requirements which came into force in September 2019. This includes Strong Customer Authentication (SCA), which is the latest standard of internet security in Europe.