Uncovered: money-saving perks you might have without knowing it

There are few things better than a discount or a special offer, but while you look out for vouchers and deals, you may have a number of valuable perks available that you are unaware of or not using to your full advantage.

Here we uncover five of the best benefits, and explain how you can make the most of them.

Legal protection

Has there ever been a time in your life when you thought you could use the advice of a solicitor, but were put off by the expensive fees?

Legal expenses insurance, also known as LEI or family legal protection, is designed to help you protect your rights if something goes wrong. It will cover the cost of your solicitor’s fees for issues such as unfair dismissal or discrimination at work, personal injury or disputes over faulty goods. Some policies will also pay for an accountant if you face an HM Revenue & Customs investigation, but this will only apply if you are an employee, not if you are a sole trader or have your own company.

LEI often comes free with home insurance, particularly if it’s premium cover, but few of us know about it. Have a look at your policy paperwork to see if you are covered and for how much.

The policy will cover everyone who lives at the insured address, except lodgers or guests. For each civil dispute it will typically pay out between £50,000 to £100,000 directly to the solicitors.

LEI does not cover criminal, divorce or child maintenance cases, or any issues that were already a problem when you started the policy. You may also find your choice of solicitors is limited by the fees the insurer is willing to pay.

Cover often comes with access to a free legal advice line though, which can be useful if you need to check up on your rights, and if your claim is approved it will pay your solicitors’ bills upfront, meaning you could take up a case you may not otherwise have been able to afford.

If you do have to pay extra to add LEI to your policy, it is likely to cost around £25 a year. Make sure you look at the small print when you sign up so you know when it might come in handy.

Medical services

View image in fullscreenMany income protection policies come with benefits such as remote GP consultations.

View image in fullscreenMany income protection policies come with benefits such as remote GP consultations.

Photograph: Zoom/PA

Income protection policies are designed to cover you in times of hardship, and to make sure you have enough money to keep food on your table and a roof over your head if you are suddenly unable to work. Critical illness insurance pays out a tax-free lump sum if you’re diagnosed as critically ill.

But did you know that these types of policy often come with a raft of free health and wellbeing services built in as standard? The benefits do not cost a penny extra and include access to services such as mental health support, physiotherapy and 24/7 remote GP consultations.

What’s more, your partner or spouse and your children will also be covered, and there is no limit to how many times you can access the services or how long your consultation lasts.

“Physiotherapy, counselling and virtual GP services can prove valuable at a time of need, especially given that the NHS is under immense strain due to the pandemic,” says Katie Crook-Davies, a spokeswoman for the Income Protection Task Force (IPTF).

Services such as virtual GPs not only deliver quick access to medical support, treatment and prescriptions, but may also be a preferable route for many who would rather not attend the doctor’s surgery in person.

“For parents who are juggling home working and home schooling, being able to jump on a quick video call with a physio for advice around an injury or some muscular pain would likely prove a welcome convenience,” Crook-Davies says.

These services are usually available to all customers and using them will not affect your insurance cover, which will continue to step in if ever you fall ill or have an accident which means you are unable to work.

If you have an income protection insurance policy already but you’re not sure which additional services you have access to, ask your insurer, broker or adviser, who will be able to help.

Work perks

View image in fullscreenSome workplace discount schemes include savings on energy bills. Photograph: Simon Dack/Alamy

View image in fullscreenSome workplace discount schemes include savings on energy bills. Photograph: Simon Dack/Alamy

Many workplaces operate a retail discount scheme to help staff save money on everyday expenses. The pandemic may mean that we are currently unable to cash in on restaurant deals, but there are some discounts that can make a real difference for employees grappling with a reduced income.

“Some providers include energy supplier discounts,” says Pauline Iles, the principal benefits consultant at Quantum Advisory, an independent financial services consultancy. “So even something like working from home in the middle of winter could end up being a little less expensive that it might currently be.”

Your employer may also provide access to other benefits and buying arrangements such as the cycle to work scheme, which is no longer capped at a £1,000 spend.

Employee assistance programmes (EAPs) can also provide valuable support for employees who may be struggling with mental health, loneliness, debt and financial matters, and even child and elderly-care concerns.

Such schemes are free, confidential and available 24/7, and offer immediate access for employees and eligible family members.

Typically you will get access to an advice line. For people who would prefer not to talk to someone on the phone, there may also be online support, and for those with a specific counselling need, an EAP may provide a number of structured sessions.

Some support services may include other practical matters, such as access to a legal helpline, which can be a great help for those looking for professional advice on points of law without incurring a cost.

To find out if your workplace offers this type of scheme, contact your human resources department or look on your company’s intranet.

Breakdown benefits

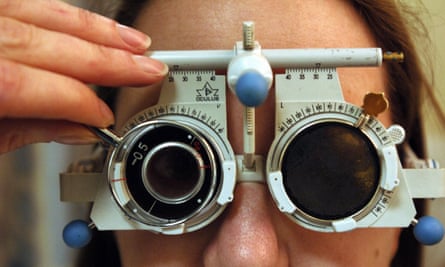

View image in fullscreenAll AA policies offer free eye tests at Vision Express. Photograph: Martin Godwin/The Guardian

View image in fullscreenAll AA policies offer free eye tests at Vision Express. Photograph: Martin Godwin/The Guardian

No one wants to be left lingering at the side of the road if their car conks out, and when you buy breakdown cover for your journeys you may obtain other perks.

All AA policies, for instance, offer 25% off an English Heritage membership, a 10% discount at Halfords and free eye tests at Vision Express. The latter includes discounts on prescription glasses and a free three-month supply of disposable contact lenses.

During the coronavirus pandemic, most car breakdown insurance providers are also assisting customers who work for the NHS even if their policy would not usually cover their incident.

A number of providers, such as Green Flag, have gone a step further, and will attend to the car of any NHS worker for free, including non-members.

Shareholder perks

Some companies offer benefits when you invest in their shares, and if you use them properly you could make some considerable savings.

Mulberry, the luxury handbag brand, offers investors with 500 or more shares – excluding those held in a self-invested personal pension (Sipp) – a discount card giving them 20% off in certain stores.

Next investors with 100 or more shares are offered a voucher giving them a 25% discount against one purchase of full-price goods in one of its stores.

Meanwhile, if you are a big reader, Harry Potter publisher Bloomsbury has a deal where someone holding one or more shares gets a discount of 35% off the recommended retail price on all books (print only) published by the company and bought via its websites. You fill in a form and it sends you a discount code.

Quite a few pub, restaurant and hospitality companies offer similar shareholder schemes where you get a card or vouchers giving you a discount on meals, drinks or accommodation.

Investment firm Hargreaves Lansdown has rounded up many of the shareholder perks, benefits and discounts that are available at hl.co.uk/shares/shareholder-perks.

Bear in mind that these perks are not in themselves a good reason for buying shares in a company. To warrant a place in your portfolio, the share should be a viable investment and the benefit a bonus.

Remember also that shares and any income they pay will rise and fall in value over time, so you could get back less than you invest.