Cladding scandal: flat owners fear bills of up to £45,000 for safety failings

Homeowners are receiving new bills for fire safety measures, three-and-a-half years after the Grenfell Tower tragedy.

Leaseholders in flats around the country are learning that their buildings have failed inspections and that they face huge bills to put things right. Many have seen hundreds of pounds added to their monthly service charges to cover short-term safety measures, or been told that work to make their buildings safe could cost them tens of thousands of pounds.

“Our financial and mental health is being seriously impacted on a daily basis, and this has only been intensified by our being locked down in our unsafe flats,” says Giles Grover of Manchester Cladiators, a co-founder of the national End Our Cladding Scandal campaign.

While some of the buildings have external cladding of the type used at Grenfell, at many the concerns involve missing fire breaks, potentially dangerous insulation or internal issues. Some homeowners were unaware that there could be a problem until they were landed with a bill.

Some are paying for “waking watch” services, where security guards are employed to keep an eye on buildings and alert residents in case of a fire. Others have seen their service charges double to meet increased insurance premiums.

Over the past two years, the government has announced a series of measures to help fix the problem, including a £1bn building safety fund to help with the cost of removing cladding and £30m to pay for alarm systems. One of its advisers recently raised the idea of building owners taking out long-term loans, with costs recouped from residents.

But campaigners point out that there are still huge gaps in aid – for example, the funds only cover buildings at least 18 metres tall – and leaseholders are likely to pay for years to come.

Government funding “is wholly inadequate”, Grover says, and draft legislation would mean leaseholders have to pay. Many fear being “shackled with long-term loans of potentially tens of thousands of pounds for serious safety issues we had no part in creating”.

The Ministry of Housing, Communities and Local Government says work is complete or under way on 93% of high-rise buildings with unsafe cladding of the type that was on the Grenfell tower.

“We know many people are worried – our priority is removing dangerous cladding as quickly as possible, backed by £1.6bn of funding,” it said in a statement.

“Building safety is the responsibility of building owners and costs of remediation work should be met without passing them on to leaseholders. We are considering options to fund this and will set out further details in due course.”

Guardian Money spoke to three homeowners about their plight.

‘An ordeal compounded further by Covid-19 restrictions’

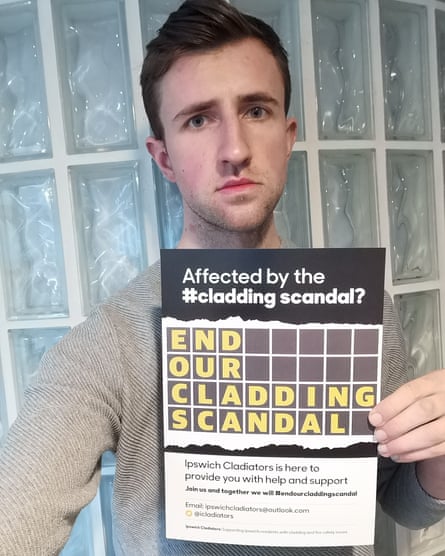

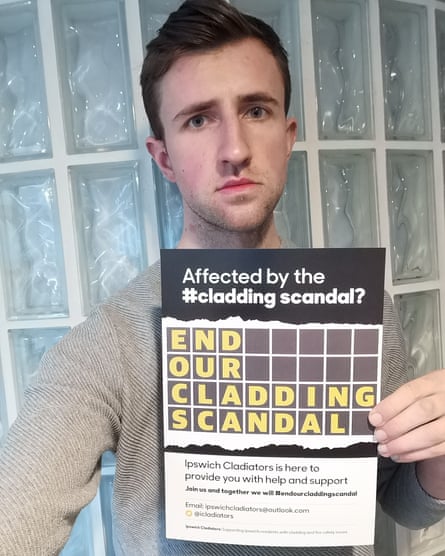

View image in fullscreenAlex Dickin: ‘It was a bit of a shock.’ Photograph: Alex Dickin

View image in fullscreenAlex Dickin: ‘It was a bit of a shock.’ Photograph: Alex Dickin

Alex Dickin, 27, bought his flat in Ipswich in February 2016, a year before the Grenfell Tower fire, when problems with cladding were not in the spotlight.

“Saving a deposit for this took five years and became a huge milestone in my life, having chosen an apprenticeship rather than going to university,” he says.

Five years later, he and 79 other leaseholders face big bills. In October last year his service charge went up from £150 to £450 a month to cover the cost of a waking watch, and this month he was told he faced a further £12,000 bill towards making the building safe.

“In 2018 a safety assessment was done and the company summarised our building as ‘minimal fire risk’,” Dickin says. “We were quite happy: when an inspection is done like that, you expect it to have looked at all of the details.”

But new managing agents commissioned another inspection and this unearthed problems. As well as cladding on upper floors, there are fire breaks missing from external walls.

“It was a bit of a shock,” he says. “The first we knew was when we noticed two men in hi-vis jackets downstairs in the lobby. Then we got a letter saying there was a new fire policy in place, and it was no longer ‘stay put’ but an evacuation policy.”

He says the waking watch was “a constant reminder of the situation we have been forced into”. The £300 cost is equivalent to 20% of his salary – “not a cost that you would ever plan to pay”. The building’s freeholder has applied to the government’s building safety fund and intends to apply to the new waking watch relief fund. But Dickin is unsure how much difference this will make to the costs he faces.

Plans to move out have also had to be put on hold as any buyer would need proof that fire-safety work had been done in order to get a mortgage.

“This has been an ordeal compounded further by the Covid-19 restrictions,” he says. “I have been unable to rely on the caring support from friends and family in person. There have been many sleepless nights as well as days where I’ve needed to sign off work due to stress.”

‘I’ll have to go bankrupt’

View image in fullscreenTimea Szabo lives in a shared-ownership flat in London. Photograph: Timea Szabo

View image in fullscreenTimea Szabo lives in a shared-ownership flat in London. Photograph: Timea Szabo

Timea Szabo lives in a two-bedroom shared-ownership flat in the Royal Artillery Quays development in Woolwich, London. She bought a 30% share of the flat in December 2018. Now residents have been given notice of £13m of work to remove external cladding. The cost for Szabo is expected to be £45,000, though she is awaiting confirmation.

“Never at any point did anyone say, ‘By the way, you might have to replace the whole outside of the building’,” she says. “Even though I only own 30%, I have to pay the full cost.”

This kind of sum, as she pointed out, would be a struggle for anyone to raise but “the reason I’m in shared ownership is because I have a low income”.

The developer, Barratt, has offered £1.3m to pay for internal work. Her housing association, Optivo, does not offer any kind of payment support for its shared-ownership tenants.

They could ease the mental pressure by providing more information – right now, I’m staring into the voidTimea Szabo

Szabo feels she is in a catch-22 situation. Her lease, just 99 years when the flat was built, is down to 86 now and needs renewing. “My lease is running down because although the mortgage lender values the property at zero now, they won’t extend the lease on that basis,” she says. “It’s worth zero. But if I want to extend the lease it’s worth £375,000.”

Money worries and concerns about living in what could be a dangerous flat with her son are taking their toll. “If they issue a bill I have to pay within six months, that’s it, I’m finished – I’ll have to go bankrupt, and then I won’t be able to work as I’m in financial services,” Szabo says. “They could ease the mental pressure by providing more information – right now, I’m staring into the void.”

Optivo says that despite being the landlord for 24 of the 418 apartments across the site, it is not the freeholder or the managing agent, and has no responsibility for the block or the work required. It says: “Along with other housing associations, we are continuing to lobby government to make funding available to protect leaseholders from fire safety remediation work costs. We have always been clear that Optivo will only pass on costs to leaseholders as a last resort, after all other options have been exhausted.”

A spokesman for Barratt says: “We are talking to the leaseholders at Royal Artillery Quays about the difficulties they are facing, and we are meeting them in the next fortnight alongside expert fire engineers to try to find a satisfactory solution.”

‘We were offered an insurance renewal at a greatly inflated premium’

View image in fullscreenAndrew Brook has lived in his central Manchester flat for five years. Photograph: Andrew Brook

View image in fullscreenAndrew Brook has lived in his central Manchester flat for five years. Photograph: Andrew Brook

Andrew Brook, 39, has lived in his central Manchester flat for five years and is a director of the management company. It is one of four buildings in a development, and problems emerged at one of the others in late 2019.

“The four buildings have now had the checks and, in one way or another, three have compliance issues,” he says. One building lacked a central fire alarm system, which had to be installed last year, while others were missing internal fire breaks, and there were concerns about the safety of the insulation.

Inspections are ongoing, and it is not clear what costs leaseholders will face for the work, but they have just been hit with higher service charges to cover an increase in insurance premiums.

“Last July we found out the insurers were not going to renew the insurance – it was a big surprise at the time,” he says. “In the end, we were offered a renewal at a greatly inflated premium … We felt we had no choice but take it – I have heard there are other buildings that have been left without insurance.”

For the building he lives in, the premium has gone up from approximately £15,000 a year to £103,000, and the excess – the amount policyholders would need to pay towards a claim – has also increased. Shortly before Christmas, leaseholders received the bill and some had their service charge more than double as a result.

While some in the development may benefit from the building safety fund, Brook and his neighbours will not. “My building is under 18 metres, so there is no government fund we can apply to,” he says.

This article was amended on 2 February 2021. An account related to a report about flammable cladding at Royal Artillery Quays was removed, while text was added to clarify that Optivo says it has no responsibility for the block in question, nor the remedial work required.