The World Bank predicts global remittances will fall by 20% this year

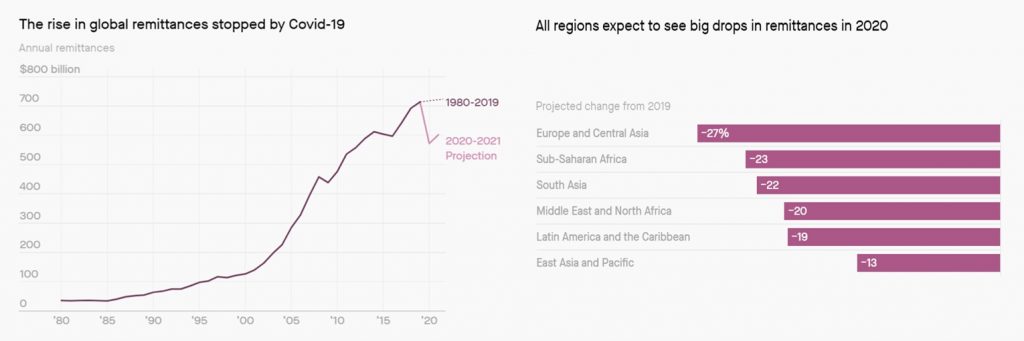

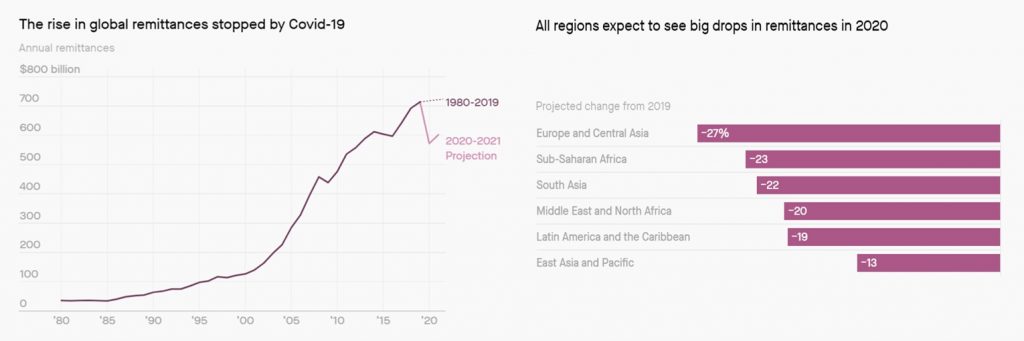

Remittances have played an increasingly important role in the economies of many low-income countries as migrants around the world have been sending an increasing amount of money home in recent decades. But that trend has been significantly interrupted by the COVID-19 global pandemic.

Remittances are expected to drop by 20% in 2020 to $445 billion (£360 billion), “representing the loss of a crucial financial lifeline for many vulnerable households”, the World Bank said, according to its latest forecast . This would be the largest single-year decline in remittances in the past century. The last global financial crisis saw remittances drop by 5% in 2009.

The World Bank bases its prediction mostly on a fall in wages and employment of migrant workers. Many currently work in industries experiencing significant layoffs, and in countries hit hard by COVID-19, particularly across Europe and North America.

The impact is felt across all regions. Central Asia countries are predicted to see the largest drop due to the combined effect of COVID-19 and the crashing oil price. Remittances made up 29% of Kyrgyzstan’s GDP in 2019, about three quarters of which came from Russia. The depreciation of the Russian ruble to US dollars could lead to a drop in remittances from Russia.

Countries in the east Asia and Pacific region are the least impacted. A number of countries whose economies are largely dependent on remittances have already enacted fiscal policies to cope with the impact.

The lock downs globally have forced neighbourhood shops that provide remittance services to close or cut open hours, making the normal money transfer routes inaccessible. These shops are not categorised as essential services in most countries as the amount of money going through them do not make up a large share of the economic activities of the remittance-sending countries, according to Dilip Ratha, the lead economist for migration and remittances at the World Bank.

“Hundreds of millions if not billions of people [are affected],” says Ratha, “It is only when you begin to think of the rest of the world, and you want to help the rest of the world, and think of one world, that is when you begin to realise the importance of remittances. This is the time to really take note of the small changes that could make huge impact in many parts of the world.”

Ratha said the developed world has come to depend on migrant workers for cheap and skilled labour, and should do more to alleviate their situation. They need access to healthcare for themselves and their families and cut-price banking facilities, which would allow them to send money home without paying high fees and commissions.

Last year, remittances reached an all-time high of $554 billion. Next year, the World Bank expects a 5.6% recovery from the $445 billion predicted this year to $470 billion.

Still, remittances is seen as a more resilient channel of foreign currency inflow than others. The World Bank estimates foreign direct investment to fall by 35% in 2020 and private portfolio flows through stock and bond markets to drop by 80%.